Tim Colebatch is what a economics journalist should be, what happened to Stage 3 and how to tweak negative gearing

Plus a shout-out to the Beatles

Hello, I’m back!

I am most certainly remaining more than true to my promise to never send you more than one of these a week.

Actually, I’m sorry. The last one was in November.

Returning from my holidays in January I got to see my mentor and guiding light Tim Colebatch two more times before he died on January 21.

No better miner of data for the truth worked in Australian journalism.

Tim and I lived in the same suburb, largely because he suggested it.

He was the master and I was his apprentice during his final five years as economics editor of The Age, and then I attempted to fill his shoes.

This piece I wrote for Peter Brown at Inside Story gives a flavour of what Tim meant to me and his other colleagues and the good he did for the nation. It’s more personal than the piece I usually write.

But one of the early anecdotes in it is undersold.

I was about to start working with Tim Colebatch. I happened to be speaking to Melbourne economist Nick Gruen, who told me that Tim was extraordinary.

Gruen said he had read something Tim had written, based on figures no one else knew about, and asked Tim where he had got them from. He said Tim sent him Tim’s figures — pages and pages of photocopied calculations done by hand. Tim had dug into several different documents (before the age of spreadsheets), copied out masses of figures by hand and combined them to discover something that wasn’t at all apparent from any of the individual documents. It must have taken hours. Nick said he had a vision of Tim’s wife (Mary) watching the television while Tim did sheet after sheet, calculation after calculation without complaint.

Here’s the story as Nick Gruen remembers it. It is more vivid.

Tim had done it all on an exercise book, about 100 cells a page – it would have been weeks of work. You could have set it up in an hour or two on a spreadsheet.

Tim inhabited data – lived in it, needed to live in it – and used it to change minds.

I’ve been on what seems to have been the right side of history twice lately, on rejigging the Stage 3 tax cuts, and on fuel-efficiency standards.

Here’s another candidate. We could make negative gearing work for us.

In Australia, an astounding one million of us negatively gear – more than one in nine taxpayers. In 2020-21 they claimed losses amounting to $8.7 billion meaning if they didn’t do it (if they didn’t claim for what seem to be deliberate losses) the rest of us could pay less tax.

What Albanese said on the weekend was half right. Negative gearing encourages investment. Most months, more than one in three new home loans is for an investment property.

But most of those loans don’t increase supply – the thing Albanese says matters.

That’s because the overwhelming bulk of investor home loans go to “investors” planning to buy existing homes – to bid against and likely beat would-be owner-occupiers.

In December 2023, only 23% of the loans to investors was used to build a home or buy a newly-built home. In November only 19%.

It’s a confronting graph. Four out of every five investor loans are used to trump a would-be owner-occupier bidding for a home rather than to build one.

What I suggest is what used to be Labor’s policy.

All he would need to do is what Labor promised to do in 2016 and again in 2019. In those elections, Bill Shorten went to voters promising to limit the use of negative gearing to newly-built homes.

The sieve would no longer leak. Every dollar of tax lost to a negative gearer would help build a home.

What would have happened if Shorten had got his way: if Australia both focused the use of negative gearing and cut the capital gains discount as he had proposed?

Modelling just published in Australian Economic Papers finds the share of households who own their home rather than renting it would have climbed 4.7%.

Over to you Albo and co. One thing’s for certain. After what happened after Albo modified Stage 3, no one will believe him if he goes into the next election promising not to change tax. The only credible approach is to promise to change tax; all the better if some of the changes are spelled out ahead of time.

I reckon things have changed since Shorten first proposed focusing negative gearing and winding back capital gains tax concessions. Back then Shorten and Morrison were able to scare people by claiming it would weaken – “smash” – housing prices.

These days a lot of people would welcome weaker prices.

Speaking of weaker prices. Despite the instinctive continuing handwringing from the RBA, the battle against runaway inflation has been won.

This graph from John Hawkins in The Conversation on January 31 tells the story:

But things still feel bad. That’s because, for many of us – mortgaged wage earners – the cost of living has climbed by much, much more than the consumer price index.

As I outlined in The Conversation

Way back in the late 1990s, more than a quarter of a century ago, the consumer price index (CPI) used to actually reflect the cost of living. It included all of the big costs incurred by households, including – importantly – mortgage interest payments. At the time, mortgages accounted for an average of $5 of every $100 each wage earner spent.

Then in September 1998, in response to representations from the Reserve Bank and the Treasury, the bureau changed the way it calculated the index. It excluded mortgage and other interest payments, in a decision it acknowledged would make the index worse at measuring living costs.

It still carries the warning on its website, saying the consumer price index is “not the conceptually ideal measure for assessing the changes in the purchasing power of the disposable incomes of households”.

The index actually does a pretty good job of measuring changes in living costs at times when mortgage rates aren’t much changing. But at times when they are tumbling, it’ll overestimate living costs. And when mortgage rates are soaring – as they have been lately – it will way understate what’s happening to living costs.

The actual average cost of living for working households climbed by 6.9% over the past year according to the relevant ABS living cost index, rather than the 4.3% recorded in the consumer price index.

Beware the CPI at times like this.

On Monday February 5, just ahead of the first RBA board meeting for the year, The Conversation published its survey of the forecasts of 31 leading economists.

When graphed, their forecasts show annual CPI growth coming down quickly, on average sinking from 4.3% to 3.5% by the end of this year and to 2.9% by the end of next year:

Yet here’s the thing. The RBA’s forecasts released the following day show it coming down faster, sinking to 3.2% by the end of this year and to 2.8% by the end of next year.

You wouldn’t know it from the RBA’s rhetoric.

Oh, and economic growth will be dismal.

The panel expects very low growth of just 1.7% in 2024, climbing to 2.3% in 2025. Both are well below the 2.75% the treasury believes the economy is capable of.

All but one of the forecasts are for economic growth below the present population growth rate of 2.4%, suggesting that the panel expects population growth to exceed economic growth for the second year running, extending Australia’s so-called per capita recession.

Oh yes, the real Stage 3

Can we stop with the class warfare stuff already?

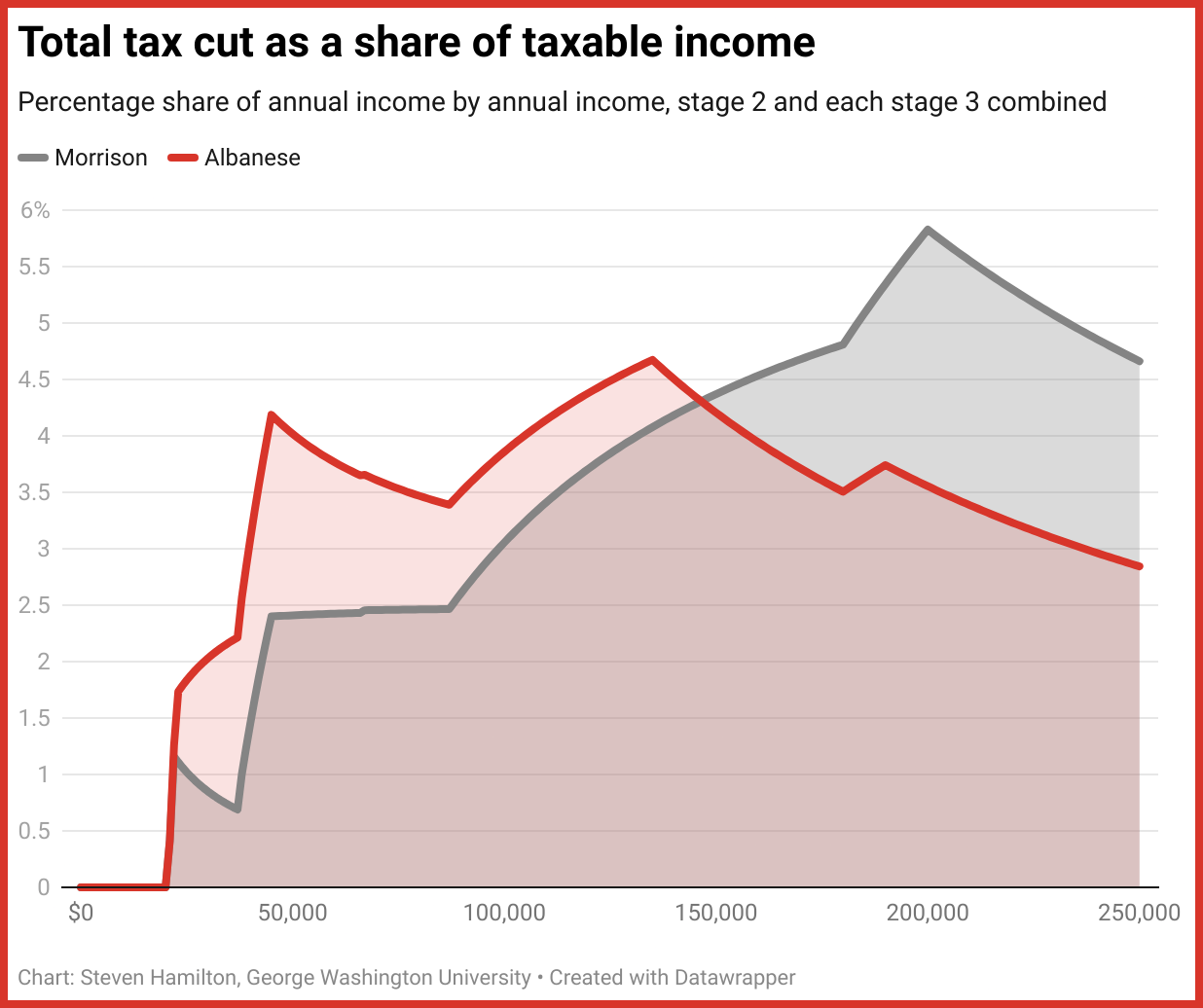

Stephen Hamilton set us straight.

Stage 1 (the temporary low and middle-income tax offset) didn’t last. Weird, I know.

That means that all that matters for what happens to who pays tax is stages 2 and 3 taken together.

Stephen has graphed Labor’s combination of both on top of the Coaltiion’s combination of both.

What Labor is doing is in red. Its impact is

broadly flat, which is how it ought to be if the government wanted to leave the progressivity of the tax system unchanged.

It is certainly not a Robin Hood package. It doesn’t take from the rich and give to the poor (except by taking tax cuts high earners thought they were going to get).

What the Coalition proposed and legislated is in grey. Its benefits are funnelled to high earners. And don

And don’t get Steve (or me) started on bracket creep.

Busting a Beatles myth

I’ve long accepted as true the myth that when the Beatles toured Australia 60 years ago in June 1964 they couldn’t hear themselves , what with all the screaming and the poor foldback) and played badly.

I found this cassette in my garage, from Junee 12, 1979, on the 15th anniversary when 5KA played what was presumably recorded through the mixing desk.

I only got to record a bit. But it sounds as if they played well.

That’s it for now.

Keep reading The Conversation (I edit the pieces on economics) and for that matter keep reading Inside Story, John Menadue’s Blog, and Post, a free 7am weekday email from The Saturday Paper.

My column is in The Conversation (almost) every Wednesday.

You can subscribe to the daily email from The Conversation by clicking “Get newsletter” at the top of the Conversation AU homepage:

See you soon. Feel free to dip into some of Tim’s best writing, And feel free to write.

Best wishes,

Peter